what animals are affected by clear cutting

3 ways cuts in tax allowances will affect freelancers

Despite reaching that stage of my life when, seemingly, all around me are unable to play because they are saving up for procreation or marriage, I too live very frugally in pursuit of a long and healthy career doing something I love.

Over my seven years of freelancing as a full-time illustrator, my earnings have seen a slow increase. In turn, I travel more to attend meetings and execute jobs on location.

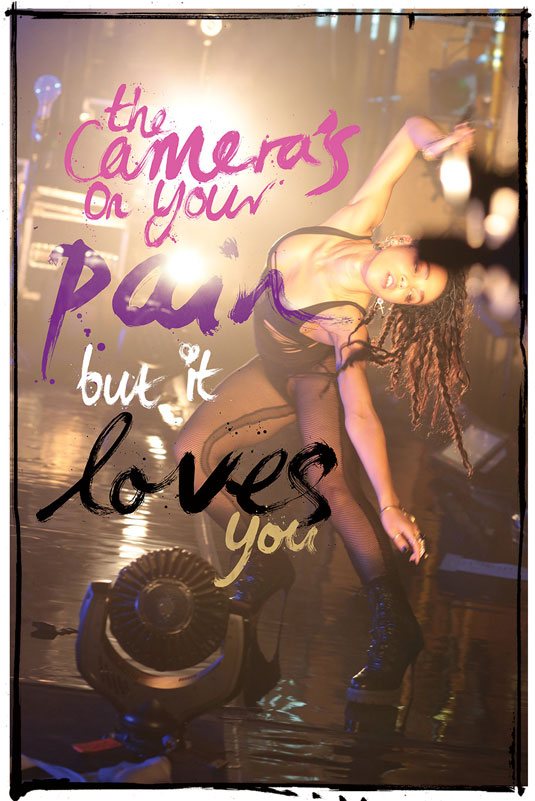

Only last week, I painted a mural on a nightclub wall in Southampton after a trip to Sheffield the weekend before to record my latest podcast episode. At noon, I visited a budget-friendly Mexican food establishment for lunch, costing under £7 with a complimentary can of pop...

01. Reduced mobility

What makes this kind of mobility possible is the fact that currently, I am legally entitled to reclaim a high percentage of such meagre travel costs as business expenses on my tax return.

This is certainly a far cry from the alleged extra-marital escort and private jet write-offs happening at the upper end of the business world that we routinely read about in the press. However, under proposed UK tax reforms, travel like this – no matter how frugally booked – largely won't be feasible.

02. No money to reinvest

These crucial travel and subsistence allowances mean that I often find my worst-case scenario tax bill estimation to be somewhat lower than the money I've put away after each payment is received. Then I can re-invest any excess cash into my business and therefore the oh-so-important economy.

Last year I used some excess cash to commission a film to promote my debut book, and in 2016 I'm designing a new website. Is this not the idea? Encourage us to spend more by softening the blow a little?

The recent government proposals suggest cuts on the basis that contractors' travel and subsistence allowances are 'outdated and too generous.'

On one occasion, I travelled down to see Next Plc about a big freelance interior design job, creating large murals in the children's department.

When I saw that the anytime return train ticket was over £250, I insisted that we bought the £77 off-peak ticket instead, on the basis it made no difference to us what time I travelled.

03. Lost work

These mooted cuts make me feel like my mindful ways have been rejected and returned, square in my face with twice the force. My business trips are cheap, often miserable and long, but result in essential paid work, benefitting the economy too.

But under the preposterous new proposals, I will spend less on travel and as a result, I will lose a significant amount of business.

Am I just being the excessively sensitive artist type, or should these cuts not instead be aimed at the giant corporations that reportedly engineer tax loopholes to the tune of billions?

Why is the spotlight once again being shone on small businesses, too often treated with all the respect of the vermin scavenging under the very carriages we need to travel aboard to survive?

Words: Ben Tallon

London-based freelance illustrator and art director Ben Tallon is also the author of Champagne and Wax Crayons.

This article first appeared inside Computer Arts issue 249, a special issue looking at how to power up your skills as a freelancer and more, on sale here.

Liked this? Read these...

- How to power up your skills as a freelancer

- 10 things nobody tells you about going freelance

- The designer's guide to working from home

Related articles

what animals are affected by clear cutting

Source: https://www.creativebloq.com/business/3-ways-cuts-tax-allowances-will-affect-freelancers-11618712